5 Things to Think About When Choosing a Payroll Company

Payroll is a critical component of every business. Payroll service and tax duties are vital, but they can be time-consuming and complicated. While some organizations prefer to conduct payroll in-house, outsourcing payroll service improves accuracy, saves time, and allows workers to focus on their primary duties. In this blog post, we’ll look at the following topics:

The number of WSEs employed in PEO services increased at an average rate of 7.6% between 2008 and 2020. This is 7% higher than the total compound annual growth rate of the economy during the same time period.

Focus Points:

- All of the dull administrative chores that come with owning a business are taken care of for you when you engage with a PEO payroll firm. This allows you to dedicate more time to the day-to-day operations of your business.

- Most PEO service providers offer civil protection and employment liability insurance in the event that a former employee sues your company for racism or wrongful termination.

- Most PEO service providers offer civil protection and employment liability insurance in the event that a former employee sues your company for racism or wrongful termination.

Payroll outsourcing has a number of advantages.

Regardless of its size, location, or nature, a firm might benefit from outsourcing key services such as payroll.

Some of the advantages of outsourcing payroll are as follows:

- Savings of time

Among other things, managing payroll processing include keeping track of benefit deductions, paid time off, terminations, and new hires. - Experts manage the payroll functions.

Payroll accountants are professionals in dealing with the complexities of national insurance and taxes. They can manage deductions and benefits in the payroll system using their extensive understanding of HMRC legislation. - Reduction in costs

Payroll outsourcing is a wise decision for any business owner. Wages, training, software investments, and recurring payments for payroll personnel can be a money pit for firms, with no guarantee of the same results. - Improved security

Due to the hazards and complexity of payroll processing, it necessitates significant supervision. Due to the sensitivity of the data, proper security measures for access, storage, retrieval, and data processing are required.

-

Focus on Core Business: By outsourcing payroll, businesses can redirect their focus on core business activities and strategic initiatives. It frees up time and resources that would otherwise be spent on payroll processing, allowing management to concentrate on growth, innovation, and driving the company forward.

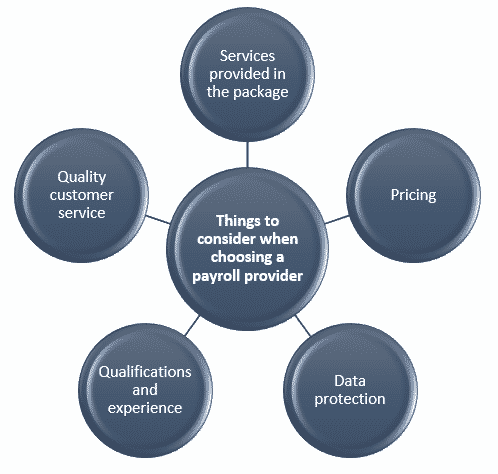

Consider These Factors While Selecting a Payroll Service Provider

After deciding to outsource your company’s payroll services because of the benefits that a payroll specialist can give, the following step is to find a provider that best matches your business and satisfies your demands.

As a result, selecting a professional, competent, and trustworthy service provider is crucial.

Each payroll service provider is unique and provides services in a different way.

After weighing your options, it’s critical to make sure you pick the correct partner.

If you’re not sure where to start, think about the following factors when choosing a payroll service:

1. The package includes services.

Every business need its own set of payroll services. A good payroll service provider should offer customized services and have the requisite skills to suit all of the company’s requirements.

After determining which mix of services is appropriate for the firm’s growth, the supplier should additionally give the firm extra updated features in addition to the fundamental functions.

2. Pricing

The services included in the package (both primary and supplementary features), the size and kind of the firm, location, and other factors all influence outsourced payroll pricing. It’s crucial to do your homework and compare the various pricing schemes offered by different payroll service providers. The most typical pricing structures given by providers are fixed and variable pricing models. While money is important when hiring a payroll specialist, the cheapest option is not necessarily the best.

3. Data security

In today’s environment, where data breaches are on the rise, sensitive data protection is a major priority for any firm.To maintain the security of clients’ data, a good payroll service provider should have adequate regulations and protocols in place.To discover a trustworthy specialist for your business, you can ask your network for recommendations and research the reputations, client testimonials, and reviews of potential service providers.

4. Excellent client service

Client unhappiness might be caused by payroll service specialists who do not provide good customer service. Because you’re entrusting a portion of your company’s responsibilities to someone else, it’s vital that you communicate with your payroll provider on a regular basis.Look for a company that can comprehend your business and its problems, reply to all of your inquiries and concerns, and offer online do-it-yourself (DIY) support. You must ensure that your business continues to grow and prosper.

And, as it continues to expand, your payroll needs will increase as well. You’ll need a payroll expert who can handle the complexities of payroll while also assisting you as your company expands. In terms of capacity and infrastructure, your supplier should be able to handle a big volume of work in the future.Furthermore, your service provider should be adaptable enough to deal with shifting conditions effectively.

Wrap up

It’s challenging to pick a payroll service provider. Consider a few alternatives to ensure you don’t make a mistake when choosing a payroll service provider.

You can use the criteria stated above to narrow down your options and choose which supplier is the best fit for your business. During the interview with the applicants or outsourcing to a third party, you should strive to build a positive relationship with anyone you hire for your company.

It’s vital to realize that if this process is broken, you’re jeopardizing your company’s growth.

After all, nothing irritates employees more than being paid erroneously and late.